Traffic data

Milan Malpena and Milan Linate airport traffic

| Movements | Passengers (1) | Cargo (tonnes) (2) | ||||

|---|---|---|---|---|---|---|

| 2016 | change % vs 2015 | 2016 | CHANGE % vs 2015 | 2016 | CHANGE % vs 2015 | |

| Malpensa | 162,683 | 3.9% | 19,311.6 | 4.7% | 536,862 | 7.4% |

| Linate | 97,828 | 1.9% | 9,636.2 | 0.0% | 12,553 | 1.0% |

| Total commercial traffic | 260,511 | 3.1% | 28,947.8 | 3.1% | 549,415 | 7.2% |

(1) Arriving + departing passengers (thousands)

(2) Cargo arriving + departing in tonnes

During 2016, more than 28.9 million passengers transited the Milan airport system managed by the SEA Group, with a 3.1% growth over the previous year.

Linate airport reported a result basically in line with the previous year, while Malpensa posted a +4.7% growth over 2015.

Malpensa's result was mainly determined by an increase in Terminal 1 traffic totalling +7.0% and confirmation of passengers transiting at Terminal 2 where only the easyJet airline works (+0.6%).

The performance of Terminal 1 is mainly linked to the development of Ryanair (+630 thousand passengers compared to 2015) and the growth of other low cost airlines (+256 thousand equal to +17.2%, where Vueling contributed with +194 thousand passengers, totalling +41.1%) and a substantial consolidation of the intercontinental segment (-12 thousand passengers, equal to -0.2%) against a decreased result for other airlines (-61 thousand passengers, totalling -0.6%).

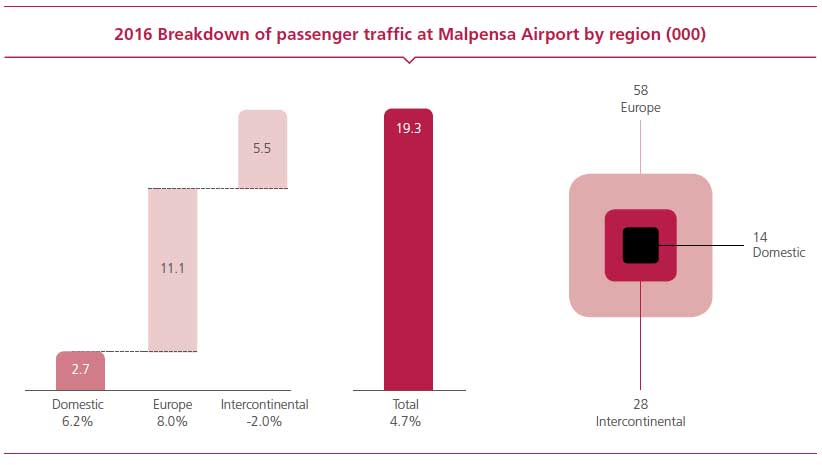

In terms of Malpensa's intercontinental traffic (5.5 million passengers served, a figure which also includes non-EU routes flown by easyJet at Terminal 2), it should be noted that the segment, which reported a -2% performance compared to 2015, was affected by the geopolitical instability of countries on the Middle Eastern part of the Mediterranean Sea and the Maghreb, and the events that involved Turkey. By excluding the Maghreb countries and analysing the performance of long-haul airlines to the remaining areas, a development of +1.6% was reported with 4.9 million passengers served in 2016.

The breakdown of passenger traffic on the Milan Airport System by main destinations and operating airlines is provided below.

Main destinations in terms of passengers served by the Milan airport system (000)

London was once again the number one European destination in terms of passenger traffic in 2016, with a traffic volume to its five airports exceeding 2 million, followed by Paris (Charles de Gaulle and Orly), Amsterdam and Madrid. New York and Dubai were again the first two destinations for intercontinental flights. On a national level traffic to Rome Fiumicino continued to fall, however it is still the number one destination, followed by Catania and Naples.

| YEAR 2016 | CHANGE % 2015 | inc. % TOTAL | ||

|---|---|---|---|---|

| 1 | LONDON | 2,260.7 | 18.6% | 8% |

| 2 | PARIS | 1,681.6 | -0.9% | 6% |

| 3 | ROME | 1,480.3 | -12.2% | 5% |

| 4 | CATANIA | 1,190.7 | 9.0% | 4% |

| 5 | AMSTERDAM | 1,115.0 | 10.7% | 4% |

| 6 | NAPLES | 877.1 | -15.3% | 3% |

| 7 | NEW YORK | 841.0 | 1.3% | 3% |

| 8 | MADRID | 822.5 | 8.4% | 3% |

| 9 | FRANKFURT | 767.3 | 0.4% | 3% |

| 10 | BARCELONA | 752.7 | 5.0% | 3% |

| 11 | CAGLIARI | 719.9 | 10.5% | 2% |

| 12 | PALERMO | 683.6 | 3.6% | 2% |

| 13 | OLBIA | 617.8 | 8.2% | 2% |

| 14 | DUBAI | 587.6 | -2.9% | 2% |

| 15 | BARI | 562.4 | 3.4% | 2% |

| Others | 13,987.8 | 3.2% | 48% | |

| Total | 28,947.8 | 3.1% | 100% |

London: Heathrow, Gatwick, City, Luton and Stansted; Paris: Charles de Gaulle andOrly; Rome: Fiumicino and Ciampino; New York: New York and Newark

Main airlines in terms of passengers served by the Milan airport system (000)

EasyJet is the main airline in terms of volume of traffic at the Milan airports (Linate and Malpensa), with a 26% incidence on total transited passengers (+1% over 2015) while Alitalia (the second airline, contributes 22% of passengers (with a 23% decrease compared to the previous year, due to the continual and progressive reduction of its operations). The full operation of Ryanair in 2016 should be noted, which with 665,000 passengers is the eighth airline operating at the Milan airports in terms of managed traffic.

| Year 2016 | Var %2015 | Inc. % of the total | |

|---|---|---|---|

| Easyjet | 7,393.5 | 3.3% | 26% |

| Alitalia | 6,237.6 | -2.8% | 22% |

| Lufthansa | 1,392.2 | -2.4% | 5% |

| Meridiana Fly | 1,178.7 | 5.5% | 4% |

| Emirates | 845.4 | 1.9% | 3% |

| British Airways | 695.1 | -6.3% | 2% |

| Vueling Airlines S.a. | 667.5 | 41.2% | 2% |

| Ryanair | 665.1 | 1772.1% | 2% |

| Air France | 510.1 | -6.1% | 2% |

| Neos | 510.1 | -3.2% | 2% |

| Iberia | 428.0 | 8.6% | 1% |

| Turkish Airlines | 401.5 | -12.6% | 1% |

| Klm | 385.4 | 1.2% | 1% |

| Qatar Airways | 313,3 | 7.1% | 1% |

| Aeroflot | 311.7 | 7.9% | 1% |

| Others | 7,012.7 | 0.2% | 24% |

| Total | 28,947.8 | 3.1% | 100% |

Malpensa

Malpensa passenger traffic stood at 19.3 million, recording an increase compared to the previous year (+4.7%).

Domestic traffic reported an increase of +6.2% mainly due to the operations of Ryanair which, in addition to the flight to Comiso, started flights to Catania during the current winter season; Meridiana Fly is next in terms of total value growth compared to 2015, with flights to Olbia, Catania, Palermo and Naples.

European traffic reported a development of +8%; in addition to having consolidated flights started in winter 2015 to London Stansted, Bucharest and Seville, Ryanair later began flights to Sofia, Porto, Brussels and Las Palmas. EasyJet introduced eight new flights for Manchester, Krakow, Toulouse, Lille, Bilbao, Lanzarote, Alicante and Nantes, while Vueling started Amsterdam, Las Palmas and Alicante, in addition to Barcelona and Paris Orly, Ibiza and Bilbao, already in operation.

Intercontinental destinations have undergone a 2% reduction. By removing the destinations most affected by the geopolitical instability (mainly Egypt and Tunisia) from the figures, long-haul traffic reported a 1.6% growth, with 4.8 million passengers, as described in detail below:

i) Middle East (45% of the segment total, +1.9% compared to 2015): an increase in capacity contributed to this growth primarily determined by more movements and to a lesser extent the average dimensions of the aircraft, while a slight drop in aircraft load factor was reported. Among the main airlines that fly to destination of the area in question, only Emirates posted a slight drop against the increase in passengers of all the other players (Qatar Airways Etihad Airways, Oman Air, Mahan Air and Alitalia);

ii) North America (21% of the segment total, -0.9% compared to 2015): the substantial confirmation of the previous year results is the consequence of the contrasting effects of an increase in aircraft dimensions and the lowered number of movements and load factor;

iii) Far East (19% of the segment total, -2.6% compared to 2015): the reduction in passengers is connected to the lower number of movements to the area, against an increase in load factor with basically unchanged average dimension of the aircraft. Alitalia eliminated its flight to Shanghai which had been available during EXPO, against an increase of all the other players (Air India, Thai Airways, Neos and Singapore Airlines);

iv) Central/South America (11% of the segment total, +11.8% compared to 2015): the increase versus the previous year resulted from an increase in capacity (in particular an increase in the average dimension of aircraft and secondly, from a greater number of movements) with unchanged load factor. The number of transported passengers increase for the Latam, Neos and Meridiana airlines, while Blu Panorama reported a decrease;

v) Central/South Africa (4% of the segment total, +7.4% compared to 2015): the increase versus the previous year is linked to the greater number of movements to the area and secondly to the increase in average dimensions of the aircraft, with unchanged load factor. Meridiana Fly represents the main player in the area, operating primarily in the leisure market.

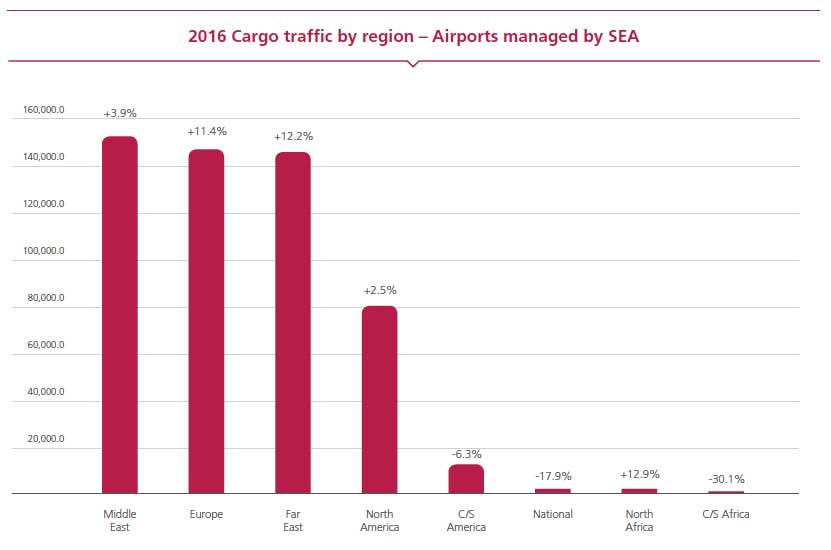

Malpensa Cargo

Malpensa airport achieved a significant performance in cargo traffic for the third year in a row (between 2013 and 2016 the airport reported an average annual increase of 8.4%, with more than an additional 115 thousand tonnes), exceeding the 537 tonnes of handled cargo (+7.4% compared to 2015) and confirming its status as a crucial centre for the distribution of imported (+5.4%) and exported (+8.7%) goods on a national level.

Specialised airlines operating in the sector that invested in the airport, contributed to this result, mainly connecting the Asian, Middle East and North American markets. The contribution of passenger flights with mixed configuration was also important.

The all-cargo traffic recorded growth of +8.9%, reaching 387 thousand tonnes of cargo moved. The following contributed to the development in the year: Cargolux group (+18.4%), Air Bridge Cargo (+31.3%) and Etihad Airways (+26.2%).

The main courier airlines all-cargo transport (Federal Express, DHL, Aerologic Swift Air) represent around 18% of the processed cargo and moved more than 70 thousand tonnes basically aligned with 2015 levels.

The belly traffic grew by +3.5%, achieving 150 tonnes of cargo transported. For airlines with mixed configuration aircraft, Emirates was the main airline for quantity of cargo moved, while the main increases compared to last year were due to Alitalia, Oman Air, Qatar Airways, Latam and Singapore Airlines.

The % change refers to comparison with the previous year

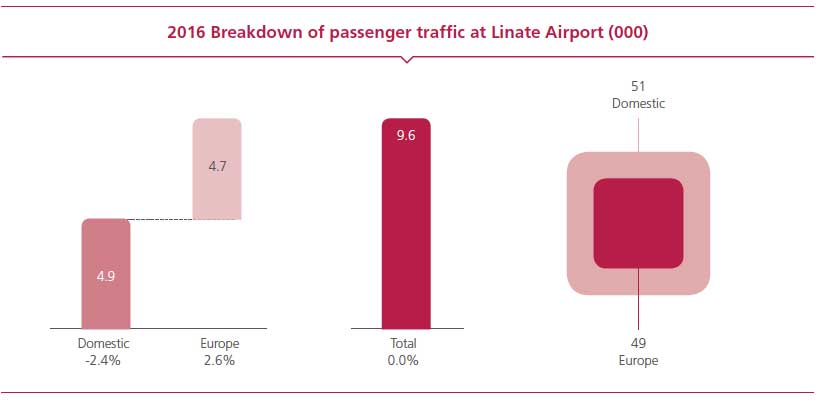

Linate

Linate airport stood at 9.6 million passengers reaching the same levels as 2015.

Alitalia, basically confirmed the share reported in the previous year (57%).

Alitalia's domestic traffic has increased towards Cagliari, Catania, Lamezia Terme, Alghero and Palermo, while it has dropped on the Linate-Fiumicino route, progressively penalised by high speed trains. Naples and Comiso have also decreased.

European traffic has dropped on all routes flown by the airline, with the exception of Barcelona, where it has remained the same. Frankfurt and London City has gone against this trend.

The Linate-Fiumicino shuttle stood at 1.2 million passengers with a decrease of -13% due almost exclusively to the decision by easyJet to permanently cancel the flight to the capital starting from winter 2015/2016.

EasyJet, after cancellation of its shuttle to Rome Fiumicino, redistributed its operations mainly towards London Gatwick, at the same time confirming flights to Paris Charles de Gaulle and Amsterdam started during the previous winter season. The number of passengers on the Paris Orly route has decreased slightly.

Of note are the growth results of Blue Air which operates a flight to the Romanian capital Bucharest, Iberia, Aer Lingus, KLM and Air Malta.

Revenue

In 2016, the Commercial Aviation business generated operating revenues of Euro 625,870 thousand, an increase of Euro 15,129 thousand (they totalled Euro 610,741 thousand in 2015).

Revenues in the previous year included non-recurring income totalling Euro 4,010 thousand related to the closing of a transaction with a supplier and enforcement of a guarantee, after these growth totals Euro 19,139 thousand.

This growth is primarily due to the Aviation business for Euro 14,903 thousand (after non-recurring revenue for 2015 totalling Euro 1,810 thousand). Higher traffic volumes contributed for Euro 11,186 thousand while the mist favourable traffic mix, determined by the increase in average aircraft dimension, together with the increase in tariffs, resulted in higher revenues for Euro 4,039 thousand. These increases were partly offset by the decrease in revenues generated from aircraft de-icing totalling Euro 322 thousand, due to the better weather conditions in 2016 compared to the previous year.

Non Aviation revenues totalled Euro 216,900 thousand, rising Euro 4,236 thousand (after non-recurring revenues of 2015 amounting to Euro 2,200 thousand). This performance was determined by the good results of the retail (Shops, Food & Beverage, Car Rental and Banks) and carparks businesses which achieved an overall increase of Euro 4,695 thousand. The contribution of the Premium Services and Real Estate business was also positive, their revenues increased by Euro 1,068 thousand and Euro 569 thousand, respectively. Advertising revenues dropped by Euro 1,686 thousand compared to the previous year, which had benefited from extraordinary investments connected with the EXPO event, particularly at Malpensa Terminal 1.

Revenues from the Cargo business stood at Euro 12,688 thousand, basically in line with the previous year. It should be noted that delivery of the new Fedex warehouse was postponed to January 2017; it was initially scheduled for October 2016 and the assignment of new spaces to DHL starting in the second half of 2016.

In terms of the Retail segment, which contributed to the growth for Euro 1,619 thousand, revenues from shops reported an increase of Euro 880 thousand with a Euro 1,113 thousand increase at Malpensa and a Euro 233 thousand decrease at Linate.

Malpensa's good performance is particularly significant, even more so considering the construction work in the Schengen Boarding area at Malpensa's Terminal 1, started in the second part of the year, which aside from making passengers' travel experience difficult, led to a series of closing and movements of stores at times with renegotiation of agreements.

Revenues from the Food & Beverage segment grew by Euro 828 thousand (rising from Euro 18,211 thousand in 2015 to Euro 19,039 thousand in 2016).

Linate, with a traffic context the same as the previous year, reported a 6% growth (Euro 304 thousand) thanks to the good performance of the various formats present, including Panino Giusto, Sweet & Bagel Factory and in particular the “Ferrari Spazio Bollicine” wine bar near the Milan-Rome boarding area and very popular with the business clientèle.

Malpensa reported an overall growth of 4% (Euro 524 thousand). Terminal 1 recorded a good performance sustained by an additional growth of the formats present in the check-in area on the mezzanine floor and the addition of new offer proposals. Use of the Terminal 2 offer in the check-in area has been affected by the construction areas to create the new security filters, which redefined the air side and land side boundaries.

Revenues from the Car Rental segment reported a growth of Euro 289 thousand compared to 2015 primarily due to the good performance of Malpensa operators and new operators (Gold Car and Car2Go) that began their businesses at Linate.

Banking services reported a decreased totalling Euro 378 thousand compared to last year, mainly the result in lower tax refund volumes. The foreign exchange business also posted a negative performance compared with 2015, when the exchange volumes were positively influenced by the EXPO event.

Revenues from the Parking sector grew by Euro 3,076 thousand (rising from Euro 57,150 thousand in 2015 to Euro 60,226 thousand in 2016).

Linate and Malpensa reported an 3.5% increase in revenues (Euro 1,573 thousand) thanks to the return to full operation of the P5 carpark of Terminal 2 and P4 of Terminal 1 at Malpensa, penalised last year by the construction for the railway station and the important recovery of market share at Terminal 2, which included the use of a promotional campaign on easyJet boarding cards.

In terms of the carpark management activity at the Bergamo Orio al Serio airport, revenues reached Euro 11,778 thousand, with an increase of 15% (Euro 1,503 thousand) compared to the same period the previous year.

These increases, in addition to connected with the good traffic performance especially at Malpensa and Bergamo, were supported by marketing activity and specific promotional campaigns in the most important season of the market.

Advertising revenues amounted to Euro 10,451 thousand, reporting a decrease over the previous year (Euro 12,137 thousand). If the positive effect generated by the 2015 EXPO event is removed from the analysis, a general good performance for the segment was confirmed, in particular, thanks to consolidation of luxury investments. Linate maintained its long-term investments and confirmed its appeal for media and telephone. In addition, major investments materialised in the last month aimed at completely upgrading the advertising offering along the roads, adding new latest generation digital products.

Operating costs

The overall operating costs of the Commercial Aviation business rose from Euro 399,769 thousand in 2015 to Euro 403,303 thousand in 2016, with an increase totalling Euro 3,534 thousand.

Personnel costs rose Euro 7,487 thousand, both due to hiring of personnel to expand the security area activities and remuneration increases linked to the National Labour Collective Contract.

Consumable materials dropped Euro 4,697 thousand. This change was mainly connected to the lower cost of natural gas totalling Euro 2,166 thousand (lowest purchase price compared to the previous year, with volumes basically aligned), lower consumption of de-icing and anti-icing chemical products for Euro 1,104 thousand, due to better weather conditions, and lower costs for spare parts and purchase of fuels totalling Euro 1,129 thousand.

The other operating costs increased by Euro 744 thousand based on the increase in direct costs directly connected to the rise in volumes, such as grants to develop traffic and fees due to the State for higher traffic generated by the airport system, against a reduction of costs mainly tied to professional services and security guard expenses.

EBITDA and EBIT

As a result of the changes discussed above, EBITDA for 2016 stood at Euro 226,076 thousand (Euro 214,574 thousand in 2015) and reported an increased compared to the following year of Euro 11,502 thousand, equal to 5.4%.

Amortisation and the restoration provision, risks and charges provision and doubtful debt provision are higher than the previous year and total Euro 6,657 thousand.

Consequently, EBIT of the Commercial Aviation business totals Euro 144,872 thousand, increasing Euro 4,844 thousand (+3.5%) compared to the previous year.

Other information

Investments/Aviation spaces development

The request for airport operating spaces in 2016 confirmed the trend of recent years, when a decrease in the demand for spaces designated for office use was reported, due a policy to reduce station costs for legacy airlines, while airline interest remains strong for business customers who are offered exclusive facilities including Fast track and lounges.

The main elements in space development in 2016 are listed below:

- Emirates inaugurated a 94 square meter lounge-reception at Malpensa Terminal 1 in February 2016, combine with eight parking spaces for the chauffeur-drive service reserved for first and business class passengers;

- Alitalia/Etihad inaugurated a new 495 square meter lounge called "Casa Alitalia" at the North satellite in May 2016;

- a new ten year agreement with finalised with Lufthansa in December to create a new lounge in the Schengen boarding area at Malpensa, to replace the one currently in use, with an increase in the area of 164 square meters.

Development of the retail sectort

The year 2016 recorded in negative trend in passenger consumer spending, especially Chinese passengers, a phenomenon that characterised the performance of all European airports, with the exception of those in the United Kingdom.

This trend was caused both by oscillations in exchange rates and duties imposed by the Chinese authorities on luxury goods at the beginning of the year, and lower propensity to visit Europe due to a fear of terrorist attacks.

This negative purchasing trend was also confirmed by the figures related to tax refund requests from passengers in Malpensa on purchases made in Italy, which reported a decrease of 11.6% compared to the previous year.

Reconstruction work continued at Malpensa Terminal 1 with the creation of a new shopping galleria accessible to passengers regardless of their destination, and organised with diversified "Squares" based on positioning and pricing. Worthy of mention is the opening of the Zara store in the "Piazza del Pop", a worldwide leading fast fashion brand, with an area of 700 square meters. Hudson, a large news-stand/convenience store opened in this square, and the Kiko brans and new Womo brand beauty store dedicated to a male target with adjacent Bullfrog barber were also repositioned. Redevelopment work will continue for all of 2017. A retail area with completely renovated terminal furniture and traffic layout is expected for the second part of the year.

The retail areas of the Hudson news-stands and last minute duty free shops have been increased in satellites B1 and B2, in order to propose a broader offer both for passengers coming from and going to non-Schengen destination and for passengers who cannot stop in the retail areas located before the passport controls.

The check-in area has been reorganised at Malpensa Terminal 2 with the creation of new security filters in June 2016; in addition the Hudson news-stand and My Chef Gran cafe bar have been repositioned in order to concentration all the services available for passengers checking in in a single area.

New openings at Linate regard the Yamamay shop in the air side area in May and the Benetton shop in the land side area in June, expanded in December with an area for children's products.

Self Service Bag Drop

The pilot project was started in October 2016 at Malpensa Terminal 2 and in November at Terminal 1 with the EasyJet and Aegean airlines. The service model to offer was defined with a careful comparison of what is present in major European airports and at present studies are under way to explore the possibility of delivering a single service to airlines belonging to the same alliance.

Intermodal transport

Various intermodal transport initiatives are in an analysis and development phase, their aim is to enlarge the airport catchment area and improve user services. The main ones include collaboration with various aviation and non aviation operators, both on road and rail and the distribution of connections on various sales channels.

Destination Management and Co-Marketing Activities

Collaboration continued in 2016 with MILLIBAR, MISE, Federturismo, Assolombardia, the Chamber of Commerce, Municipality of Milan and the Region of Lombardy as well as initiatives to promote the area abroad and familiarisation activities for travel agents, in particular when new destinations were inaugurated or there was an increase in flights to existing destination.

Bilateral Agreements

Two new bilateral agreements were signed with South Korea and Qatar in the first half of 2016. The former involves an increase in both passenger and cargo flights and an additional increase in destination, the latter, in addition to this also includes the stabilisation of fifth freedom traffic rights of Doha-Malpensa-Chicago flights.

A new agreement was signed with the Russian aviation authorities in July which entails an increase in flights on routes other than Moscow and new destinations.

The bilateral agreement with Hong Kong was revised in November to deregulate the number of flights and the stabilisation of fifth freedom traffic rights for cargo flights in the Hong Kong - India - Malpensa route.

Lastly, agreements were updated with Saudi Arabia, Australia, Cape Verde, Ivory Coast, Jamaica and New Zealand and agreements were stipulated for the first time with Bahamas, Benin and Curacao.